- Home

- Practice Areas

- Collections

- Resources

- Firm Overview

- Blog

- Contact

- Automobile

- Bankrupcy

- Blog

- Business Law

- Cases in the News

- Child Support

- Courtney Curran Vore

- Criminal Law

- Davi M. Peters

- David C. Tencza

- Divorce

- Elder Law

- Employment Law

- Estate Planning

- Family Law

- Firm News & Updates

- Forms

- General

- George H. Thompson

- Guardianship & Conservatorship

- Israel F. Piedra

- Jack S. White

- John Polgrean

- Joseph W. Conti

- Land Use Law

- Landlord/Tenant Law

- Latest News

- Legal Resources

- Mechanic’s Liens

- Mediation

- Michael J. Fontaine

- Nashua Bar Association

- News & Articles

- Personal Injury

- Question of the Week

- Real Estate

- Series: "Why Do I Need a Personal Injury Lawyer?"

- Speeding Tickets

- Thomas J. Leonard

- Uncategorized

- Valerie Raudonis

- Vehicle Infractions

- Wills & Estates

- Worker's Compensation

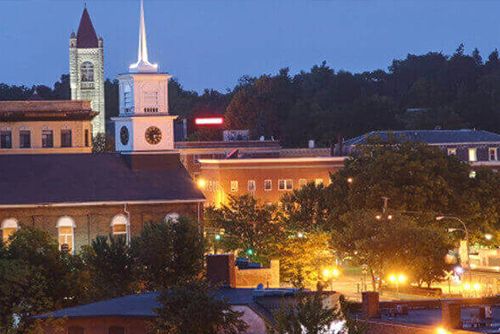

Proudly Serving New Hampsire

Top-Rated Personal Injury, Workers’ Compensation, Divorce & Family Law, and Estate Planning Attorneys.

Over 80 5-Star ![]() Google Reviews

Google Reviews

Welts, White & Fontaine, P.C. proudly boasts a 5.0 Google Rating

Please read our reviews below — we have been fighting to protect

the citizens of New Hampshire for over 45 years!

Rory Bonasoro 2023-09-20 Very helpful in representing me in defending my divorce final orders and parenting plan in Appeals. Gave me great recommendations to ensure that I would win and only did the necessary work to keep costs affordable. Saved me thousands of dollars and helped me win. Matthew Rasetta 2023-09-13 I want an attorney with a backbone that will aggressively fight for me while still maintaining a level of integrity and goodness! I also what that “needle in a haystack” to be fairly prices. Jack is that UNICORN! Dmitry Marchenko 2023-08-08 Amazing results in a somewhat difficult situation. Attorney Israel Piedra and Paralegal Christine Knutsen communicated above and beyond my expectations, explained the process and masterfully guided us through. People joke about law and dentistry, well, this experience was super pleasant. Highly impressed! jdude 2023-06-28 I worked with Attorney White after a roofer installed a completely defective roof at my house. He was professional and very pleasant to work with. Most importantly, he knew the law and the litigation process very well. I can't recommend this firm enough. Cam Q 2023-06-13 Isreal was a pleasure to work with, he did everything he could to get a positive outcome for my case, and succeeded. Would highly recommend to anyone looking for a top notch firm! Jose Valdez 2023-05-25 If I can leave 100 stars I would. Let me just say today I became a client. But these lawyers made me feel like a client since my first phone call. Thank you Sylvia, Israel, and the the hole law firm team including the front desk. I’ve been feeling so down since since I received a disgusting result. I called this law firm and thy answered my calls and followed up with everything thy said thy will. My god I feel alive again and I feel like they’re actually lawyers who really care about peoples feelings and situations. THANK YOU MUCH FOR BEING THE BEST LAW FIRM IN NEW HAMPSHIRE PERIOD Michaela Milne 2023-05-12 Attorney Piedra was an excellent asset when it came to my infant son’s burn injury he sustained while in the care of his daycare center. He was very clear and precise when explaining the process of taking legal action and what we should expect along the way and what his expectations were. His paralegal Christine always responded promptly and was ready to answer any questions that I had. I would absolutely recommend working with this firm especially Israel Piedra based off my personal experience. Laurie Galbo 2023-05-04 If you ever find yourself in need of legal assistance in the greater Nashua area, I strongly recommend you call Welts, White and Fontaine. I was recently represented by Jack White with the assistance of Christine Knutsen, and I am very happy with the outcome of this situation.

They each took the time to answer my questions as they came up, contacted me with updates and helped me reach well thought out decisions along the road to end my case.

My biggest hope is you don't need legal services as I did, but should you, call Welts, White and Fontaine Brian McCarthy 2023-05-04 I was referred to Michael Fontaine for my divorce. Michael Fontaine and Sylvie Michaud-Nelson and their entire team are truly amazing and professional in every single way. They worked an extremely hard case of mine in such a professional manner. They handled me as their client with such amazing care and professionalism. I can not thank them enough. They made a difficult impossible situation seem positive in so many ways. They handled my emotions and concerns right away. This entire Ferm is top shelf and works so extremely hard to make sure you’re their 1st priority. Thank you so much from the bottom of my heart. So grateful to have had the number 1 team through my most difficult time.

Our Proven Case Results

$500,000

Personal Injury

Homeowner/Lawnmower –

Amputated Big Toe

$450,000

Personal Injury

Trip and Fall at Supermarket

Plaza – Concussion

$250,000

Personal Injury

Motor Vehicle Accidents

Back Injury – Jury Verdict

Welcome to Welts, White & Fontaine, P.C.

Nashua Personal Injury Attorneys

Whether you were the personal injury victim of a car accident or were hurt at work, own a business and need assistance with a contract or lawsuit, are going through a divorce or custody battle, would like to prepare a will or other estate planning documents, or have any other legal matter you need assistance with, Welts, White & Fontaine, P.C. attorneys have decades of experience serving clients in the Nashua, New Hampshire area. We are Nashua’s largest law firm and are at your service.

Whether you were the personal injury victim of a car accident or were hurt at work, own a business and need assistance with a contract or lawsuit, are going through a divorce or custody battle, would like to prepare a will or other estate planning documents, or have any other legal matter you need assistance with, Welts, White & Fontaine, P.C. attorneys have decades of experience serving clients in the Nashua, New Hampshire area. We are Nashua’s largest law firm and are at your service.

Award Winning Personal Injury, Family Law and Estate Planning Lawyers

Welts, White & Fontaine, P.C. is open for business and accepting new clients. If you are a potential client and would like a consultation, contact us today!

Our Areas of Practice

Our Nashua attorneys can assis you in a wide variety of practice areas

Slip And Fall Lawyer

Bicycle Accident Lawyer

Pedestrian Accident Lawyer

Truck Accident Lawyer

Premises Liability Lawyer

Wrongful Death Lawyer

Dog Bite Injury Lawyer

Motorcycle Accident Lawyer

Car Accident Lawyer

Personal Injury Frequently Asked Questions

An appellate lawyer is an attorney who handles appeals to the New Hampshire Supreme Court or First Circuit Court of Appeals. Appeals typically have two parties: the Appellant, who is the person who lost in the trial court and is appealing, and the Appellee, who won in the trial court and is now defending the appeal.

Whether you won or lost at the court below, having an experienced appellate lawyer for your appeal is important. At Welts, White & Fontaine, PC, our attorneys have decades of experience handling complex appeals in the areas of family law, divorce, termination of parental rights, personal injury, business, real estate and zoning, and many other areas. We also pride ourselves on being more affordable than many other appellate attorneys.

Timber trespass is the wrongful cutting of someone else’s trees. When someone else, like a neighbor, cuts down your trees, you may be entitled to compensation. An experienced timber trespass lawyer can help you get compensation for your felled trees by assembling evidence, helping you hire an arborist if necessary, and presenting a settlement demand to an insurance company or defendant. Welts, White & Fontaine, PC, are experienced timber trespass lawyers who have recovered hundreds of thousands of dollars for property owners who have had their trees cut down. You may even be able to proceed on a contingency fee basis, meaning you don’t pay a fee unless you win a recovery.

The Law Offices of Welts, White & Fontaine, P.C.

29 Factory St. Nashua, NH 03060

New Clients: (603) 713-0100

Start On Your Free Case Evaluation Today!

"*" indicates required fields

The Law Offices of Welts, White & Fontaine, P.C.

29 Factory Street Nashua, New Hampshire 03060

Contact Us

New Clients: (603) 713-0100

Exisiting Clients: (603) 883-0797

FAX: (603) 883-8723

Nashua Personal Injury Resources

- Personal injury lawyer Nashua, NH

- Wrongful death lawyer Nashua, NH

- Car accident lawyer Nashua, NH

- Personal Injury Lawyer Derry, NH

- Workers Compensation Lawyer Nashua, NH

- Dog Bite Injury Lawyer Derry NH

Also serving Windham NH, Bedford NH and Milford NH.

Connect With Us

© 2024 The Law Offices of Welts, White & Fontaine, P.C.

29 Factory Street Nashua, New Hampshire 03060

Telephone: (603) 883-0797 | FAX: (603) 883-8723 | [email protected]

"*" indicates required fields